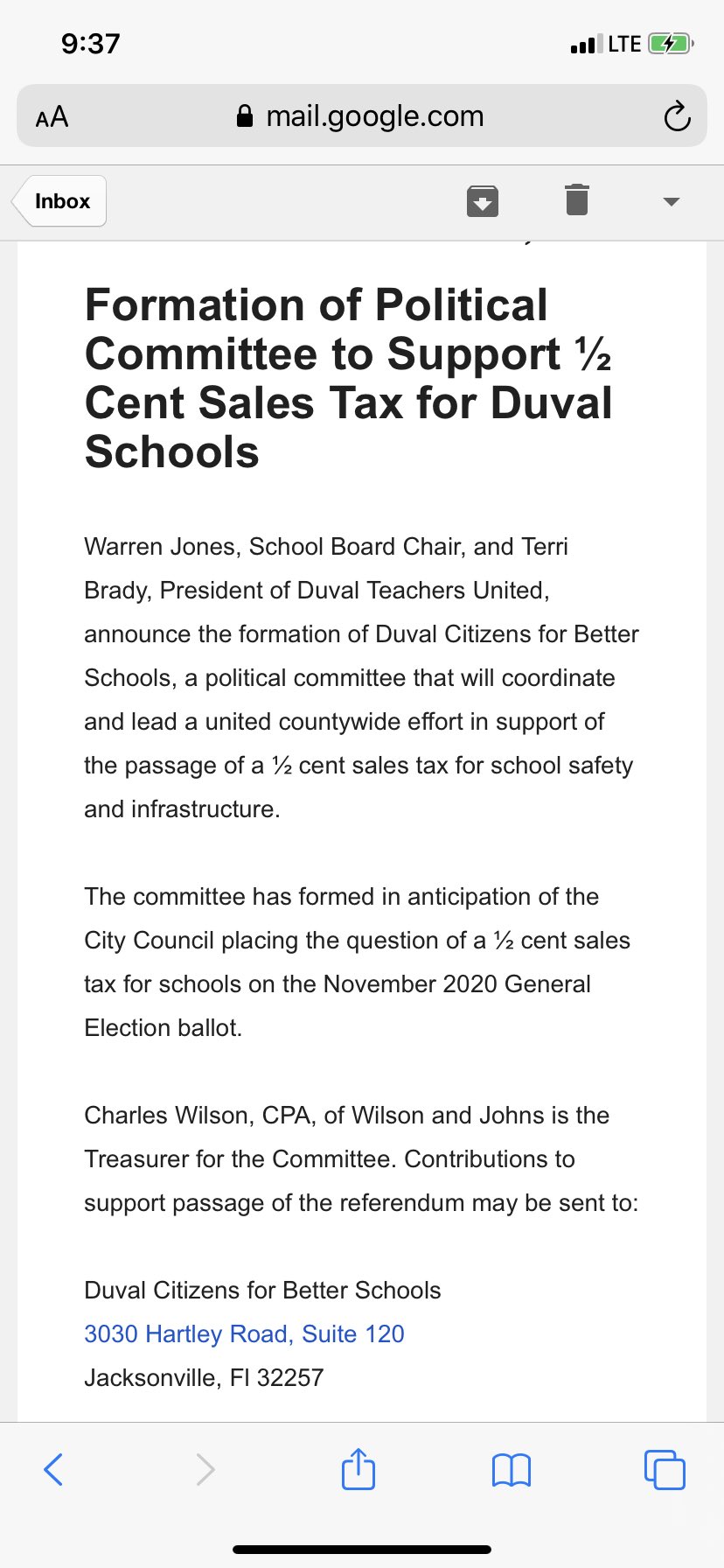

Jacksonville Fl Sales Tax 2020

Where were from there is no tax free weekend williams.

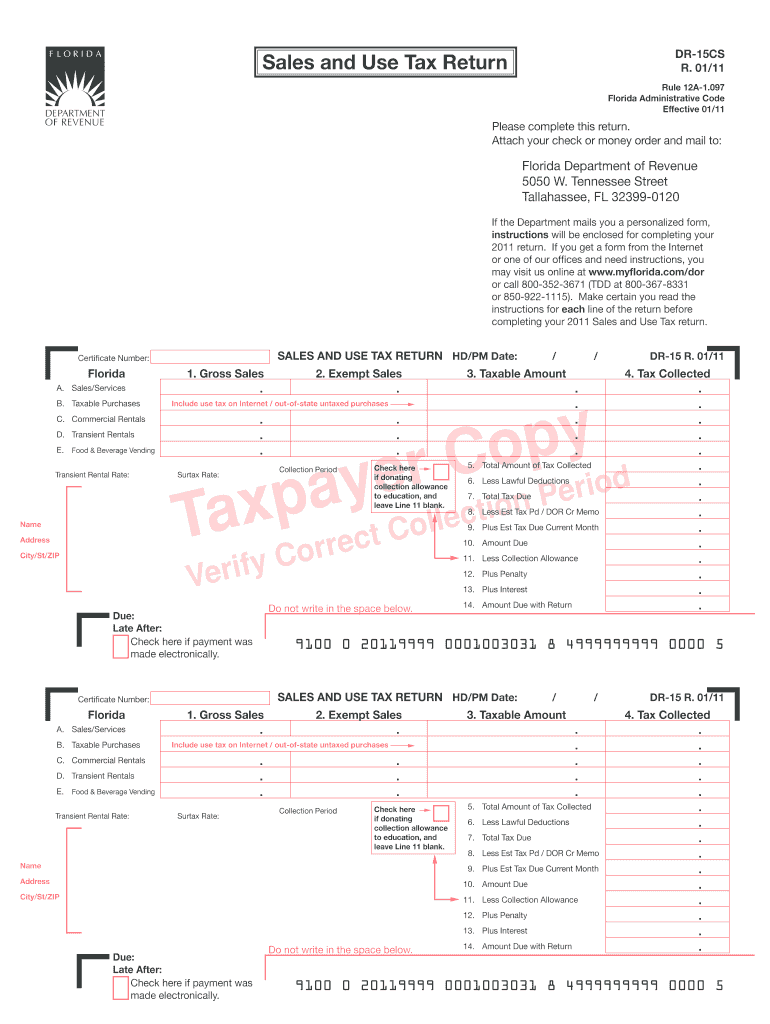

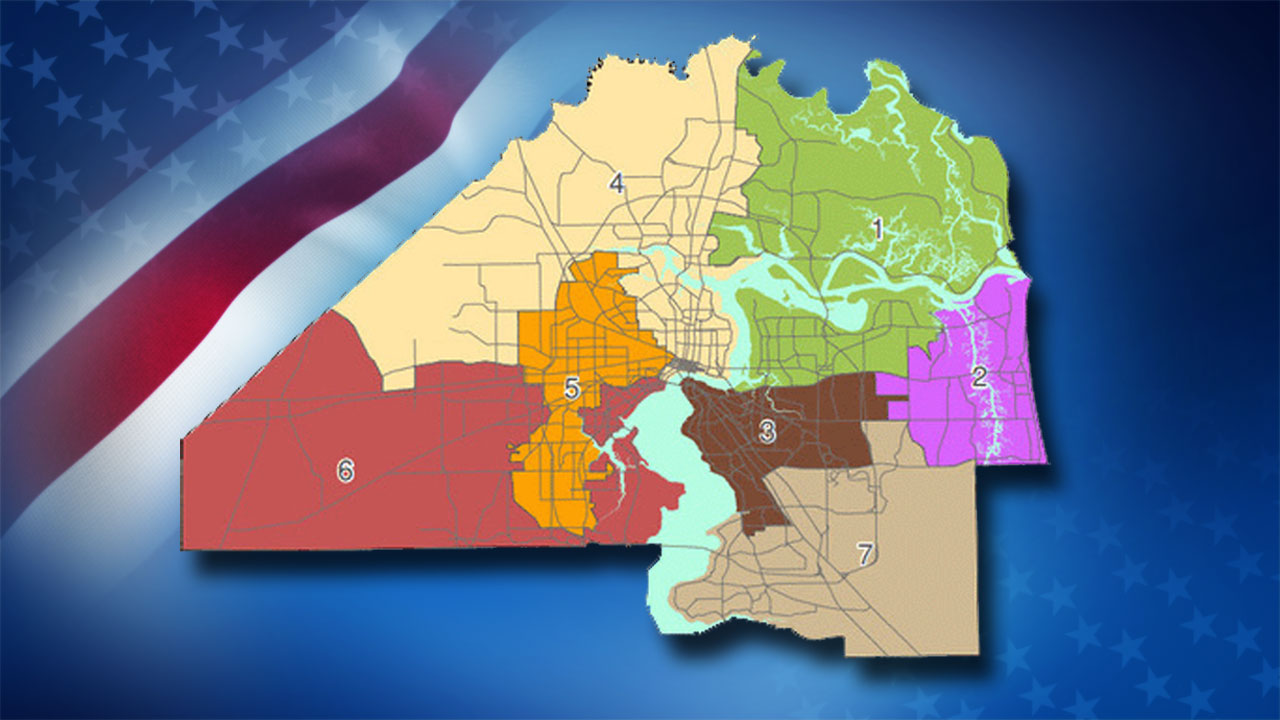

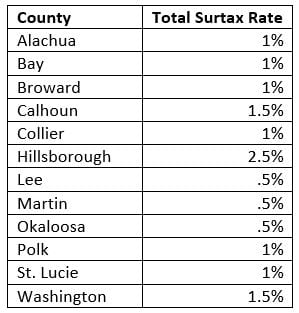

Jacksonville fl sales tax 2020. The 2018 united states supreme court decision in south dakota v. Depending on the zipcode the sales tax rate of jacksonville may vary from 6 to 7. Combined with the state sales tax the highest sales tax rate in florida is 85 in the cities of.

The current total local sales tax rate in jacksonville fl is 7000. The jacksonville florida general sales tax rate is 6. Jim overton duval county tax collector 231 e.

Every 2020 combined rates mentioned above are the results of floridastate rate 6 the county rate 05 to 1. This is the total of state county and city sales tax rates. The minimum combined 2020 sales tax rate for jacksonville florida is 7.

The duval county sales tax rate is 1. How 2020 sales taxes are calculated for zip code 32256 the 32256 jacksonville florida general sales tax rate is 7. The jacksonville sales tax rate is 0.

The roughly 2305 mile sales tax holiday shopping trip to jacksonville coincided with a visit to family here rae williams said smiling. The december 2019 total local sales tax rate was also 7000. The local sales tax rate in jacksonville florida is 7 as of august 2020.

The combined rate used in this calculator 7 is the result of the floridastate rate 6 the 32256s county rate 1. However most people will pay more than 55 because commercial rent is also subject to the local surtaxes at a rate where the building is located. The florida sales tax rate is currently 6.

How 2020 sales taxes are calculated in jacksonville. Click here for a larger sales tax map or here for a sales tax table. Jacksonville floridas sales tax rate is 7.

On january 1 2020 the state tax rate was reduced from 57 o 55.

:strip_exif(true):strip_icc(true):no_upscale(true):quality(65)/arc-anglerfish-arc2-prod-gmg.s3.amazonaws.com/public/7YV5AXWHRFGTBC5AL6TTTPQR5I.jpg)