Jacksonville Fl Sales Tax

The 2018 united states supreme court decision in south dakota v.

Jacksonville fl sales tax. Floridas general state sales tax rate is 6 with the following exceptions. 4 on amusement machine receipts 55 on the lease or license of commercial real property and 695 on electricity. The 32256 jacksonville florida general sales tax rate is 7.

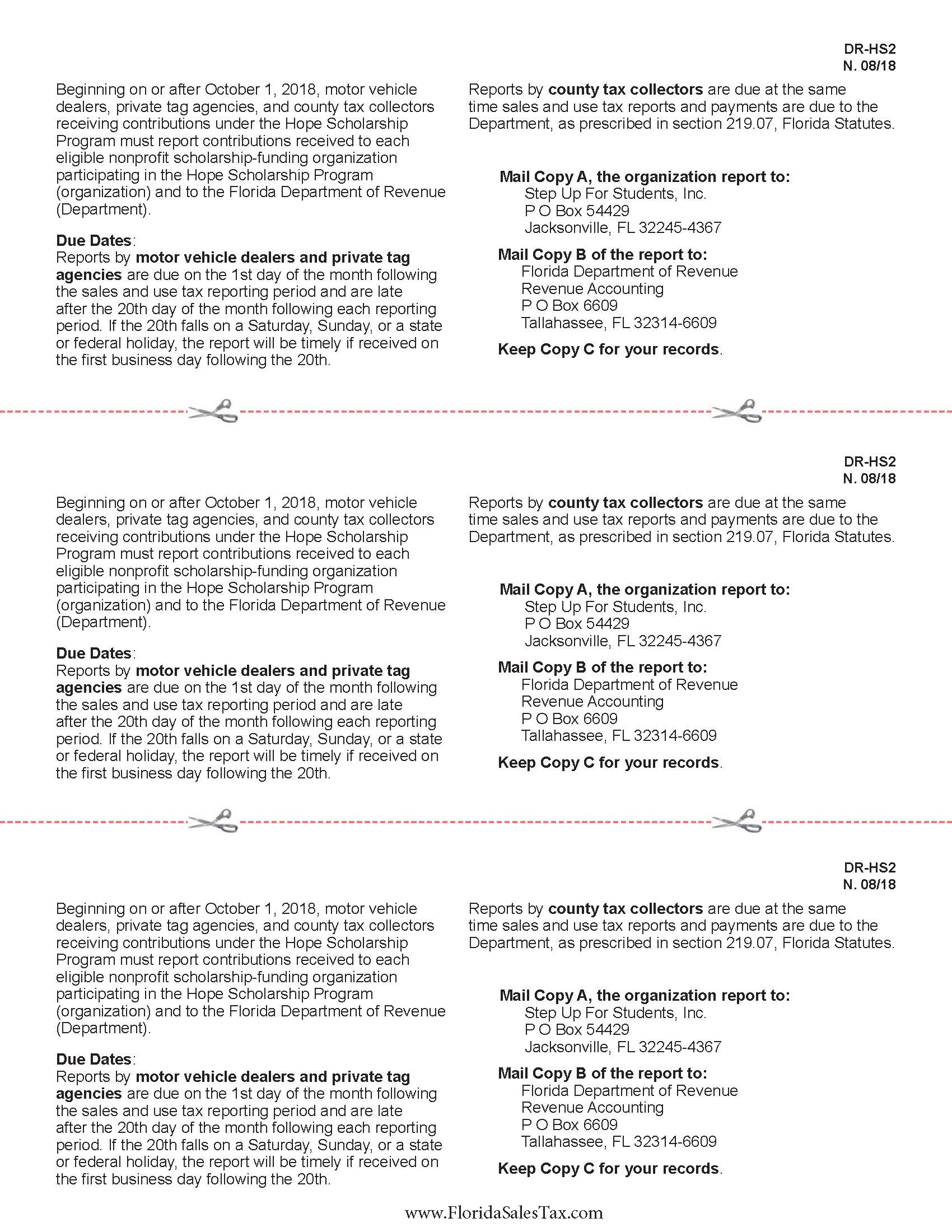

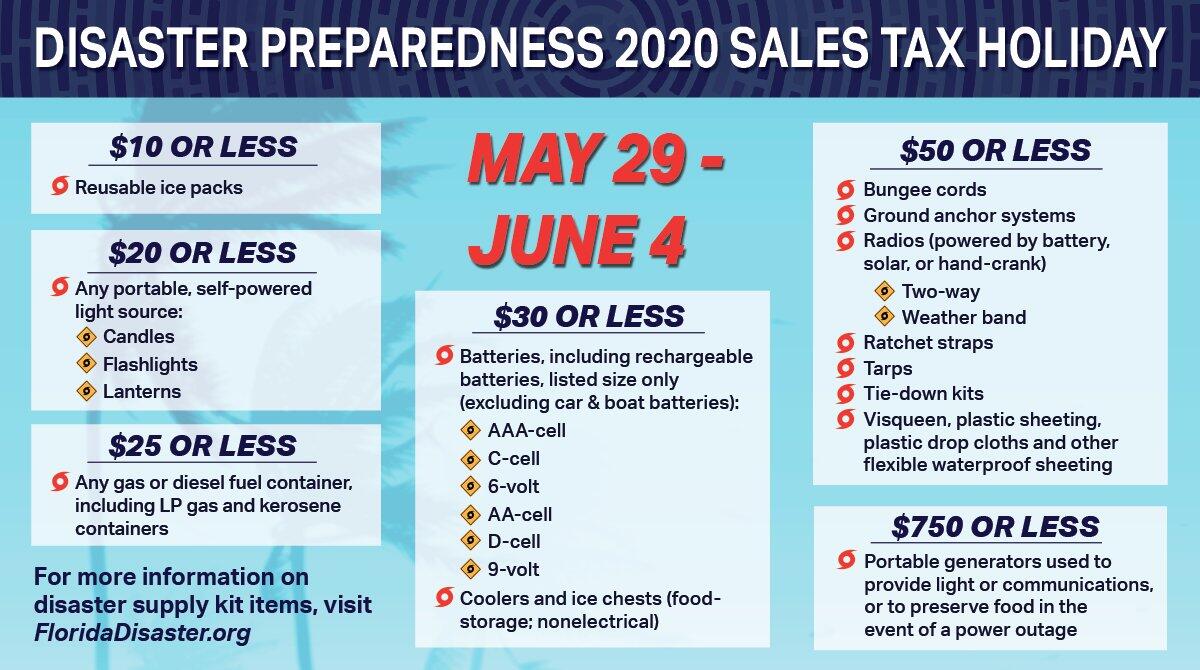

Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. 99 for the first month. On january 1 2020 the state tax rate was reduced from 57 o 55.

Jacksonville fl sales tax rate the current total local sales tax rate in jacksonville fl is 7000. The jacksonville sales tax rate is. The jacksonville florida general sales tax rate is 6.

This is the total of state county and city sales tax rates. There is no applicable city tax or special tax. Welcome to the florida sales and use tax prepaid wireless e911 fee and solid waste tax fees and surcharge website.

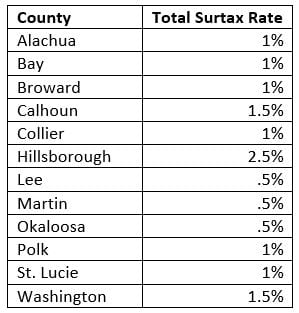

Depending on the zipcode the sales tax rate of jacksonville may vary from 6 to 7 depending on the zipcode the sales tax rate of jacksonville may vary from 6 to 7. For tax rates in other cities see florida sales taxes by city and county. The combined rate used in this calculator 7 is the result of the florida state rate 6 the 32256s county rate 1.

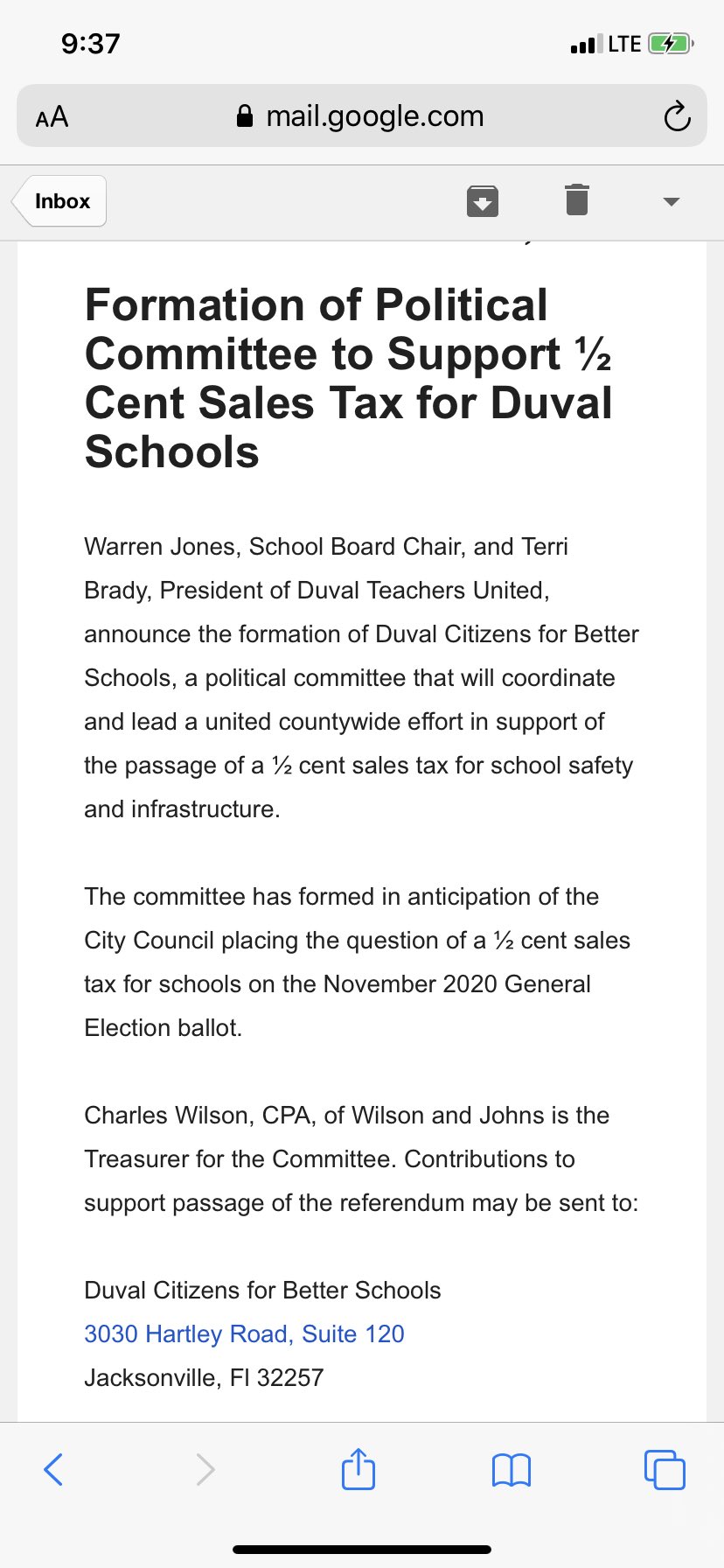

The december 2019 total local sales tax rate was also 7000. Jacksonville back to school sales tax holiday shoppers focused on backpacks shoes face masks and hand sanitizer plus pens paper and notebooks. The minimum combined 2020 sales tax rate for jacksonville florida is.

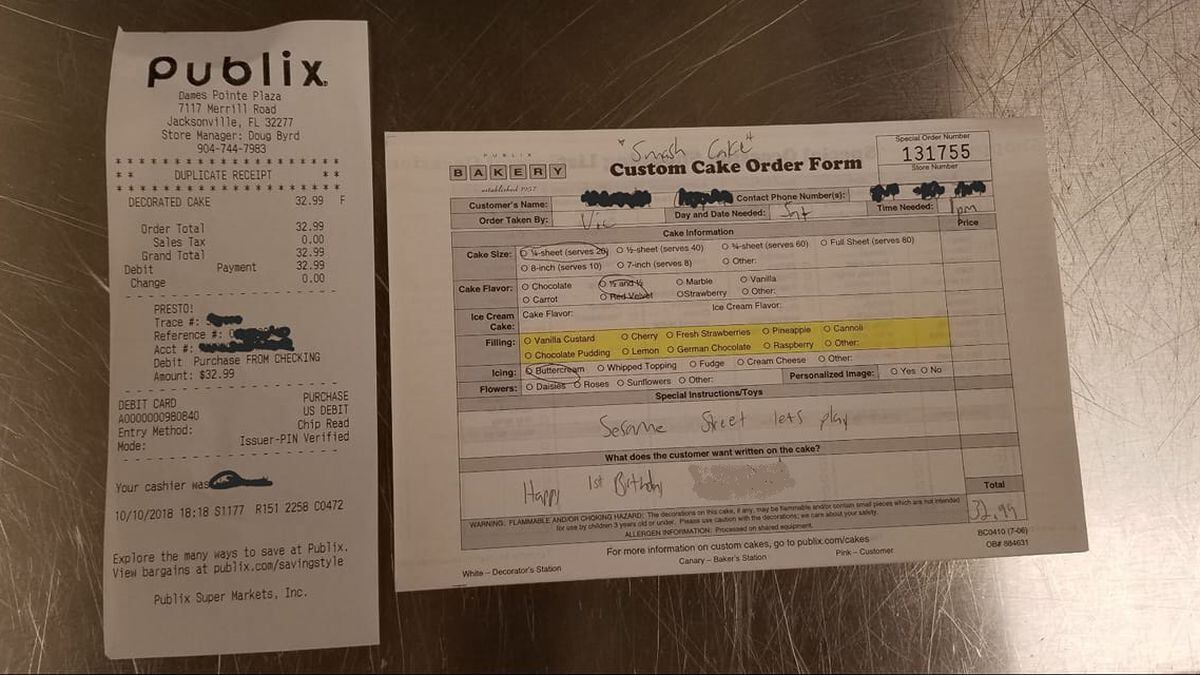

You can print a 7 sales tax table here. The 7 sales tax rate in jacksonville consists of 6 florida state sales tax and 1 duval county sales tax. Jim overton duval county tax collector 231 e.

The duval county sales tax rate is.

:strip_exif(true):strip_icc(true):no_upscale(true):quality(65)/arc-anglerfish-arc2-prod-gmg.s3.amazonaws.com/public/7YV5AXWHRFGTBC5AL6TTTPQR5I.jpg)

:strip_exif(true):strip_icc(true):no_upscale(true):quality(65)/d1vhqlrjc8h82r.cloudfront.net/03-19-2019/t_7c57caaf719448959729ea65b4120e34_name_maxresdefault.jpg)

:strip_exif(true):strip_icc(true):no_upscale(true):quality(65)/arc-anglerfish-arc2-prod-gmg.s3.amazonaws.com/public/22FIJHXNRNB2LE4WDBPHJ5QN3Q.jpg)